SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Business R&D and Innovation Survey.

by Gary Anderson and Audrey Kindlon[1]

Small businesses are often incubators of new technologies that will be important to future economic growth. Indeed, research shows that among companies engaged in research and development or in patenting, small and young firms are more innovative, more productive R&D performers, and perform research that is more radical[2] (Akcigit and Kerr 2018, Knott and Vieregger 2017).

This InfoBrief presents R&D data by company size for the years 2008–15.[3] The data are from the Business R&D and Innovation Survey (BRDIS), an annual survey of U.S.-based businesses with five or more employees that is developed and cosponsored by the National Center for Science and Engineering Statistics (NCSES) within the National Science Foundation and by the Census Bureau. Rausch (2010) presents similar data for the years 2003–07 from the Survey of Industrial R&D, which preceded BRDIS. Rausch found that smaller firms performed an increasing share of business R&D between 2003 and 2007, had greater R&D intensity (i.e., R&D/sales), and had a greater proportion of employees who are scientists and engineers.

Such data have long been of interest to researchers and policymakers. Using NCSES microdata, Knott and Vieregger (2017) found that large and small firms differ in terms of the type of R&D performed and R&D productivity. Their paper is the most recent contribution to research showing that radical innovation decreases with firm size (Mansfield 1981), the likelihood of performing process R&D increases with firm size (Scherer 1991), and R&D productivity itself varies by firm size (Acs and Audretsch 1988 and 1990, Knott and Vieregger 2017).

In 2015, following international guidance (OECD 2015), NCSES implemented an updated size classification structure based on reported employment for business R&D. This revision is consistent with the size classification used to analyze micro enterprises (5–9 employees), and it allows additional detailed statistics for small and medium enterprises (10–49 and 50–249 employees, respectively). This InfoBrief presents data[4] for 2008–15 using this updated classification structure. This international classification scheme differs considerably from that used by the U.S. Small Business Administration (SBA), which classifies businesses with fewer than 500 employees as small.

In 2015, U.S. companies performed nearly $356 billion in R&D. Large companies (those with 250 or more employees) accounted for 88% of this total. Micro and small companies (5–49 employees) accounted for just 5% of this total. Medium-sized companies (50–249 employees) accounted for the remaining 7% (table 1). Using the SBA definition of small business, these data indicate that companies with fewer than 500 employees accounted for 16% of business R&D in 2015. Rausch (2010) showed that companies with fewer than 500 employees accounted for 19% of the total industrial R&D in 2007. BRDIS data show that companies with fewer than 500 employees accounted for 20% of the total 2008 business R&D. Time series data for 2008–15 indicate changes in the level of R&D performed by particular size classes as well as in the distribution of R&D across size classes.

| Company size (number of domestic employees) |

2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|

a Business R&D and Innovation Survey does not include companies with fewer than five domestic employees. SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Business R&D and Innovation Survey. |

||||||||

| Current $millions | ||||||||

| All companies | 290,680 | 282,393 | 278,977 | 294,093 | 302,250 | 322,528 | 340,728 | 355,821 |

| Micro companiesa | ||||||||

| 5–9 | 3,947 | 4,078 | 3,851 | 4,202 | 2,926 | 3,402 | 3,295 | 2,988 |

| Small companies | ||||||||

| 10–19 | 8,433 | 5,198 | 5,721 | 4,441 | 5,011 | 5,078 | 5,063 | 5,680 |

| 20–49 | 11,525 | 12,211 | 11,626 | 13,199 | 9,099 | 9,758 | 10,542 | 10,249 |

| Medium companies | ||||||||

| 50–99 | 9,351 | 13,282 | 8,855 | 9,468 | 9,182 | 8,910 | 10,178 | 11,509 |

| 100–249 | 14,662 | 12,747 | 11,866 | 12,528 | 12,480 | 13,666 | 13,492 | 13,602 |

| Large companies | ||||||||

| 250–499 | 10,219 | 11,204 | 10,283 | 12,955 | 11,264 | 12,189 | 12,203 | 13,553 |

| 500–999 | 11,886 | 10,119 | 10,116 | 10,027 | 11,484 | 12,002 | 13,262 | 15,217 |

| 1,000–4,999 | 46,336 | 44,008 | 48,227 | 50,485 | 50,691 | 55,517 | 57,551 | 58,094 |

| 5,000–9,999 | 24,764 | 21,864 | 27,463 | 24,951 | 30,483 | 31,514 | 38,202 | 38,838 |

| 10,000–24,999 | 48,737 | 51,037 | 41,835 | 49,214 | 49,493 | 51,218 | 54,445 | 59,328 |

| 25,000 or more | 100,820 | 96,645 | 99,133 | 102,623 | 110,138 | 119,275 | 122,495 | 126,763 |

| Constant 2009 $millions | ||||||||

| All companies | 292,888 | 282,393 | 275,610 | 284,668 | 287,270 | 301,673 | 313,077 | 323,437 |

| Micro companiesa | ||||||||

| 5–9 | 3,977 | 4,078 | 3,804 | 4,068 | 2,781 | 3,182 | 3,027 | 2,716 |

| Small companies | ||||||||

| 10–19 | 8,497 | 5,198 | 5,652 | 4,299 | 4,762 | 4,749 | 4,652 | 5,163 |

| 20–49 | 11,613 | 12,211 | 11,485 | 12,776 | 8,648 | 9,127 | 9,686 | 9,316 |

| Medium companies | ||||||||

| 50–99 | 9,422 | 13,282 | 8,748 | 9,164 | 8,727 | 8,334 | 9,352 | 10,462 |

| 100–249 | 14,773 | 12,747 | 11,723 | 12,126 | 11,862 | 12,782 | 12,397 | 12,364 |

| Large companies | ||||||||

| 250–499 | 10,296 | 11,204 | 10,159 | 12,540 | 10,705 | 11,401 | 11,212 | 12,319 |

| 500–999 | 11,976 | 10,119 | 9,994 | 9,706 | 10,915 | 11,226 | 12,185 | 13,832 |

| 1,000–4,999 | 46,688 | 44,008 | 47,645 | 48,867 | 48,179 | 51,927 | 52,881 | 52,807 |

| 5,000–9,999 | 24,952 | 21,864 | 27,132 | 24,151 | 28,972 | 29,476 | 35,102 | 35,303 |

| 10,000–24,999 | 49,107 | 51,037 | 41,331 | 47,637 | 47,040 | 47,906 | 50,027 | 53,928 |

| 25,000 or more | 101,586 | 96,645 | 97,937 | 99,334 | 104,679 | 111,562 | 112,555 | 115,226 |

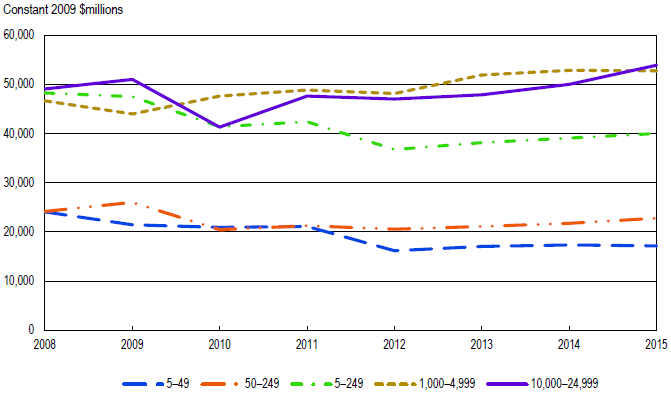

As the economy began to recover from the Great Recession in 2009, R&D performance at large companies did as well. Over the 2009–15 time period, inflation-adjusted R&D performed by large companies (250 or more employees) grew at a rate of 3% per year. However, R&D performance diverged over this time period between micro, small, and medium companies (5–249 employees) and two classes of large companies (1,000–4,999 and 10,000–24,999 employees) (figure 1). In 2008, slightly less than $50 billion in R&D was performed by micro, small, and medium companies combined and by each of these two classes of large companies. Following a period of decline, the recovery[5] of R&D performance began in 2011 for these two classes of large companies as well as for all large companies. For micro, small, and medium companies, the effects of the recession were more persistent and recovery further delayed. By 2012, R&D performance for micro, small, and medium companies had fallen to $37 billion, and recovery did not take hold until 2014. By 2015, companies with 10,000–24,999 employees performed $54 billion in R&D, yet micro, small, and medium companies performed just over $40 billion in R&D and had not recovered beyond 2009 levels.

SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Business R&D and Innovation Survey.

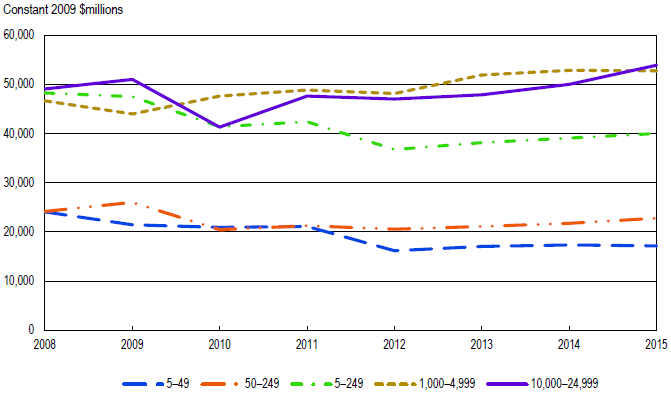

The data in figure 2 indicate that between 2009 and 2015, corresponding to the recovery from the Great Recession,[6] different size classes of businesses have fared differently with respect to inflation-adjusted R&D performance. Micro enterprises continued to perform significantly less R&D in 2015 than in 2009. Small and medium companies have not surpassed 2009 R&D performance. Large companies overall, as well as each size class of large companies other than 250–499, performed significantly more R&D in 2015 than 2009. The trends over 2008–15 for both the growth rate and share of R&D performance by micro, small, and medium companies stand in stark contrast to the 2003–07 trends. For 2003–07, Rausch (2010) showed small firms had higher growth rates in R&D performance than larger companies and an increasing share of business R&D performance.

SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Business R&D and Innovation Survey.

Another perspective on business R&D performance is revealed by looking at the degree to which company revenues from sales are spent on R&D activities. This ratio, often termed the R&D intensity, is an indication of the firm's commitment to and focus on R&D activities.

The 2008–15 data presented in table 2 show findings that are similar to those presented in Rausch (2010). For both these and earlier data, R&D intensity decreases with company size. R&D intensity, as measured by R&D as a percentage of sales, was nearly 11% for micro companies in 2015. For the largest of companies (25,000 or more employees), the R&D intensity was just over 3%.

| Company size (number of domestic employees) |

2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|

a Business R&D and Innovation Survey does not include companies with fewer than five domestic employees. NOTE: R&D intensity is the ratio of R&D to sales. SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Business R&D and Innovation Survey. |

||||||||

| Micro companiesa | ||||||||

| 5–9 | 27.9 | 9.7 | 12.9 | 11.6 | 7.0 | 6.8 | 10.1 | 10.7 |

| Small companies | ||||||||

| 10–19 | 19.4 | 10.1 | 11.6 | 7.6 | 7.5 | 6.6 | 9.1 | 8.7 |

| 20–49 | 12.8 | 8.6 | 8.0 | 6.9 | 5.3 | 5.8 | 6.3 | 5.7 |

| Medium companies | ||||||||

| 50–99 | 7.6 | 9.6 | 6.0 | 5.6 | 6.0 | 3.6 | 5.4 | 6.7 |

| 100–249 | 6.0 | 5.5 | 4.1 | 4.2 | 3.5 | 3.9 | 3.7 | 4.3 |

| Large companies | ||||||||

| 250–499 | 4.5 | 4.2 | 3.1 | 3.3 | 4.1 | 3.6 | 4.2 | 4.8 |

| 500–999 | 3.6 | 3.8 | 3.2 | 2.6 | 3.5 | 3.4 | 3.5 | 4.4 |

| 1,000–4,999 | 4.3 | 4.5 | 4.0 | 4.2 | 4.1 | 4.8 | 4.5 | 4.5 |

| 5,000–9,999 | 2.7 | 3.4 | 2.0 | 2.4 | 2.6 | 3.5 | 4.3 | 3.9 |

| 10,000–24,999 | 3.2 | 3.1 | 2.5 | 2.5 | 2.8 | 2.7 | 2.7 | 3.6 |

| 25,000 or more | 3.1 | 3.2 | 3.0 | 3.0 | 3.0 | 2.9 | 3.0 | 3.4 |

An indicator of innovative activity by companies, in particular smaller companies, is the proportion of employees that are working on R&D. According to BRDIS, the total number of employees at R&D-performing companies was 18.9 million in 2015 (table 3). In 2015, these same companies employed 1.5 million scientists, engineers, technicians, and support staff working on R&D, an 8% increase from 2008. In 2015, 15% of all employees from micro, small, or medium businesses were working on R&D, which is nearly identical to 16% in 2008 and results in no significant change during the 2008–15 time period.

| Company size (number of domestic employees) |

2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|

a Business R&D and Innovation Survey does not include companies with fewer than five domestic employees. NOTE: R&D employment includes all scientists, engineers, technicians, and support staff working on R&D. SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Business R&D and Innovation Survey. |

||||||||

| Total employment for R&D performing companies | ||||||||

| All companies | 18,516 | 17,787 | 18,636 | 19,286 | 18,293 | 20,046 | 21,540 | 18,913 |

| Micro companiesa | ||||||||

| 5–9 | 72 | 129 | 124 | 129 | 130 | 167 | 118 | 99 |

| Small companies | ||||||||

| 10–19 | 208 | 208 | 233 | 214 | 239 | 293 | 219 | 220 |

| 20–49 | 373 | 532 | 599 | 584 | 558 | 685 | 521 | 534 |

| Medium companies | ||||||||

| 50–99 | 462 | 602 | 561 | 543 | 542 | 790 | 573 | 575 |

| 100–249 | 1,039 | 853 | 1,020 | 1,057 | 993 | 986 | 953 | 855 |

| Large companies | ||||||||

| 250–499 | 710 | 721 | 732 | 1,109 | 738 | 842 | 710 | 805 |

| 500–999 | 669 | 795 | 745 | 750 | 755 | 762 | 822 | 801 |

| 1,000–4,999 | 2,587 | 2,349 | 2,628 | 3,064 | 2,583 | 2,537 | 2,593 | 2,676 |

| 5,000–9,999 | 1,464 | 1,603 | 1,651 | 1,916 | 1,557 | 1,599 | 1,524 | 1,668 |

| 10,000–24,999 | 3,903 | 2,679 | 2,555 | 2,689 | 2,590 | 2,903 | 3,848 | 2,935 |

| 25,000 or more | 7,029 | 7,316 | 7,788 | 7,231 | 7,608 | 8,482 | 9,659 | 7,745 |

| R&D employment | ||||||||

| All companies | 1,424 | 1,425 | 1,412 | 1,471 | 1,468 | 1,496 | 1,514 | 1,544 |

| Micro companiesa | ||||||||

| 5–9 | 28 | 43 | 35 | 37 | 38 | 36 | 27 | 26 |

| Small companies | ||||||||

| 10–19 | 64 | 51 | 59 | 48 | 53 | 49 | 47 | 50 |

| 20–49 | 81 | 103 | 96 | 103 | 90 | 86 | 87 | 91 |

| Medium companies | ||||||||

| 50–99 | 70 | 99 | 79 | 86 | 77 | 81 | 81 | 83 |

| 100–249 | 106 | 91 | 102 | 113 | 101 | 112 | 100 | 100 |

| Large companies | ||||||||

| 250–499 | 61 | 72 | 70 | 94 | 79 | 79 | 76 | 86 |

| 500–999 | 63 | 64 | 58 | 61 | 67 | 68 | 70 | 77 |

| 1,000–4,999 | 224 | 204 | 217 | 233 | 226 | 240 | 254 | 254 |

| 5,000–9,999 | 125 | 112 | 130 | 113 | 138 | 141 | 150 | 147 |

| 10,000–24,999 | 191 | 212 | 176 | 204 | 198 | 201 | 219 | 228 |

| 25,000 or more | 411 | 374 | 390 | 379 | 401 | 403 | 403 | 402 |

| R&D employment % of total employment in R&D performing companies | ||||||||

| Micro companiesa | ||||||||

| 5–9 | 38.9 | 33.3 | 28.2 | 28.7 | 29.2 | 21.6 | 22.9 | 26.3 |

| Small companies | ||||||||

| 10–19 | 30.8 | 24.5 | 25.3 | 22.4 | 22.2 | 16.7 | 21.5 | 22.7 |

| 20–49 | 21.7 | 19.4 | 16.0 | 17.6 | 16.1 | 12.6 | 16.7 | 17.0 |

| Medium companies | ||||||||

| 50–99 | 15.2 | 16.4 | 14.1 | 15.8 | 14.2 | 10.3 | 14.1 | 14.4 |

| 100–249 | 10.2 | 10.7 | 10.0 | 10.7 | 10.2 | 11.4 | 10.5 | 11.7 |

| Large companies | ||||||||

| 250–499 | 8.6 | 10.0 | 9.6 | 8.5 | 10.7 | 9.4 | 10.7 | 10.7 |

| 500–999 | 9.4 | 8.1 | 7.8 | 8.1 | 8.9 | 8.9 | 8.5 | 9.6 |

| 1,000–4,999 | 8.7 | 8.7 | 8.3 | 7.6 | 8.7 | 9.5 | 9.8 | 9.5 |

| 5,000–9,999 | 8.5 | 7.0 | 7.9 | 5.9 | 8.9 | 8.8 | 9.8 | 8.8 |

| 10,000–24,999 | 4.9 | 7.9 | 6.9 | 7.6 | 7.6 | 6.9 | 5.7 | 7.8 |

| 25,000 or more | 5.8 | 5.1 | 5.0 | 5.2 | 5.3 | 4.8 | 4.2 | 5.2 |

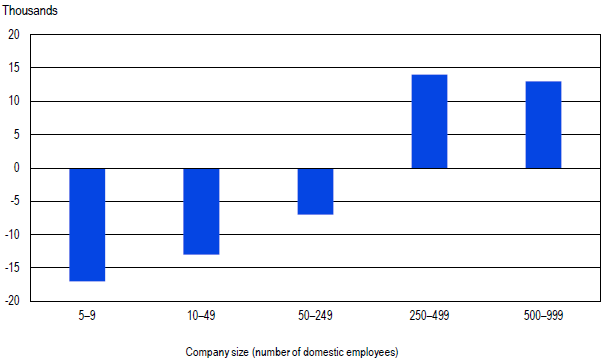

After the Great Recession, R&D workforce indicators at micro, small, and medium companies differ from those at large companies. In 2009, micro, small, and medium companies employed 2.3 million people, including 387,000 employees working in R&D. In 2015, these firms employed 2.3 million, 350,000 of whom worked on R&D. In contrast, both total employment and the number of R&D employees by large firms increased by 8% and 15%, respectively, between 2009 and 2015, the post-recession years (table 3).

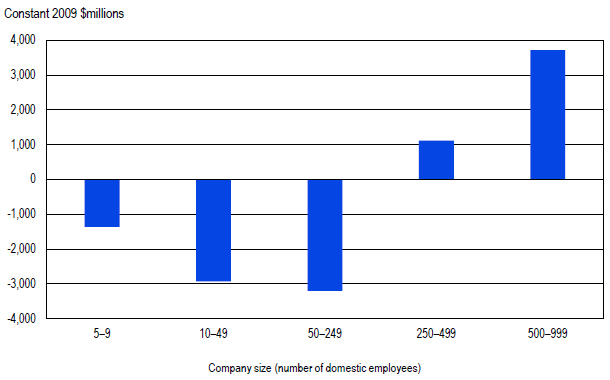

A decrease in R&D employment was most acutely experienced among the smallest firms (figure 3). During the post-recession years of 2009 to 2015, the number of personnel working on R&D at microbusinesses decreased by 40%. This compares with an 8% increase in R&D employment in all companies.

NOTE: R&D employment includes all scientists, engineers, technicians, and support staff working on R&D.

SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Business R&D and Innovation Survey.

Generally speaking, when it comes to investing in R&D, smaller companies have not weathered the after effects of the recession as well as larger companies. From 2009, when the economy began to recover from the Great Recession, until 2015, micro, small, and medium companies showed decreased R&D performance and employment, whereas large companies demonstrated a return to growth. The R&D paid for and the sales generated by domestic R&D performers decreased for micro, small, and medium companies whereas large companies experienced growth in both areas. In addition, from 2009 to 2015, the number and the proportion of employees working on R&D decreased among smaller companies.

The samples for each year of BRDIS were selected to represent all for-profit, nonfarm companies that are publicly or privately held and have five or more employees in the United States. Estimates produced from the survey and presented in this InfoBrief are restricted to companies that perform or fund R&D, either domestically or abroad. Because the statistics from the survey are based on a sample, they are subject to both sampling and nonsampling errors (see technical notes in the data table reports at https://www.nsf.gov/statistics/industry/).

Acs Z, Audretsch D. 1988. Innovation in large and small firms: An empirical analysis. American Economic Review 78:678–90.

Acs Z, Audretsch D. 1990. Innovation and Small Firms. Cambridge, MA: MIT Press.

Akcigit U, Kerr W. 2018. Growth through heterogenous innovations. Journal of Political Economy 126:1374–1443.

Knott AM, Vieregger C. 2017. Reconciling the firm size and innovation puzzle. Washington, DC: Center for Economic Studies, U.S. Census Bureau.

Mansfield E. 1981. Composition of R&D expenditure: Relationship to size of firm, concentration, and innovative output. Review of Economics and Statistics 63:610–15.

Organisation for Economic Co-operation and Development (OECD). 2015. Frascati Manual 2015: Guidelines for Collecting and Reporting Data on Research and Experimental Development: The Measurement of Scientific, Technological and Innovation Activities. Paris: OECD Publishing. Available at http://dx.doi.org/10.1787/9789264239012-en.

Rausch LM. 2010. Indicators of U.S. Small Business's Role in R&D. InfoBrief NSF 10-304. Arlington, VA: Science Resources Statistics, National Science Foundation. Available at https://www.nsf.gov/statistics/infbrief/nsf10304/.

Scherer FM. 1991. Changing perspectives on the firm size problem. In Acs ZJ, Audretsch DB, editors, Innovation and Technological Change. Ann Arbor, MI: University of Michigan Press.

[1] Gary Anderson (ganderso@nsf.gov, 703-292-8572) and Audrey Kindlon (akindlon@nsf.gov, 703-292-2332), Research and Development Statistics Program, National Center for Science and Engineering Statistics, National Science Foundation, 2415 Eisenhower Avenue, Suite W14200, Alexandria, VA 22314.

[2] Akcigit and Kerr (2018) use prior art citations in patents to characterize the novelty of the research that resulted in the patented inventions. More radical, or exploration, research does not contain any prior art citations to earlier patents held by the assignee. In contrast, in exploitation research the majority of prior art patent citations are to earlier patents held by the assignee.

[3] This InfoBrief uses constant dollars when discussing trend data. Current dollars are used for all other amounts and calculations.

[4] Although NCSES does release limited revised statistics that include adjustments based on information obtained after the original statistics were prepared, these data reflect the information available at the time of original release.

[5] Recovery of R&D performance is indicated by a statistically significant increase measured from the post-recession minimum annual performance.

[6] The National Bureau of Economic Research (NBER) dates the end of the 2007 recession as June 2009, which occurred during the 2009 BRDIS calendar year reporting period. Given that BRDIS collects annual data and 2009 corresponds to both the minimum annual real gross domestic product (GDP) over the 2007–15 period and the NBER recession date, we measure the recovery period relative to this trough.